AI for deal work

AI for deal work

Helping bankers and investors do their best work

Helping bankers and investors do their best work

Helping bankers and investors do their best work

As seen in

Leading financial publications

As seen in

Leading financial publications

As seen in leading financial publications

About

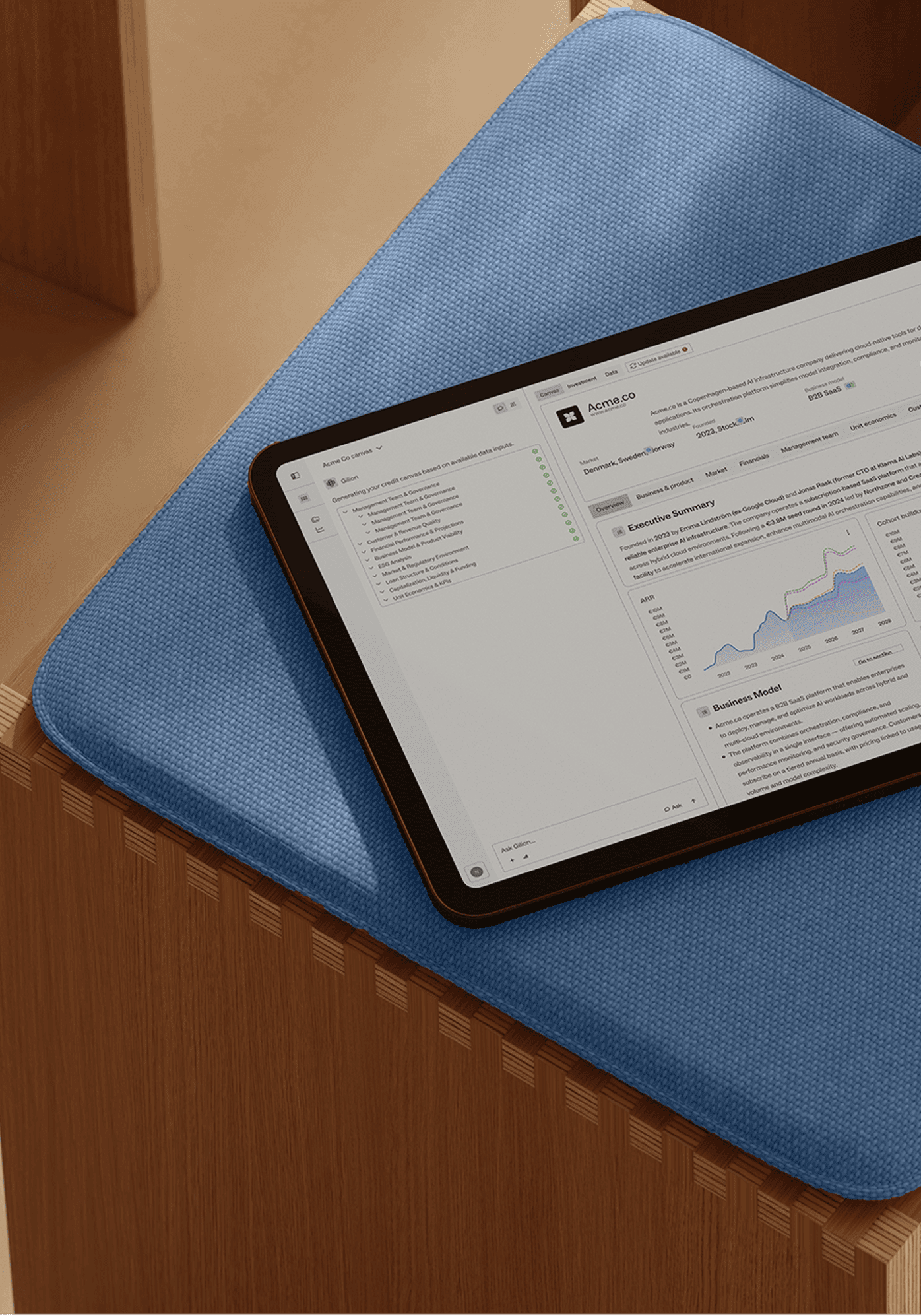

Gilion is the AI platform for financial deal work. Enabling new depths of analysis and automation of the work that shouldn’t be done by hand. Helping bankers and investors do their best work.

+56%

More deal assessments, with the same team.

-50%

Cut memo creation time in half.

-30%

Fewer credit losses or higher return on invested capital.

+61%

More capacity to manage your existing portfolio.

About

Gilion is the AI platform for financial deal work. Enabling new depths of analysis and automation of the work that shouldn’t be done by hand. Helping bankers and investors do their best work.

+56%

More deal assessments, with the same team.

-50%

Cut memo creation time in half.

-30%

Fewer credit losses or higher return on invested capital.

+61%

More capacity to manage your existing portfolio.

About

Gilion is the AI platform for financial deal work. Enabling new depths of analysis and automation of the work that shouldn’t be done by hand. Helping bankers and investors do their best work.

+56%

More deal assessments, with the same team.

-50%

Cut memo creation time in half.

-30%

Fewer credit losses or higher return on invested capital.

+61%

More capacity to manage your existing portfolio.

About

Gilion is the AI platform for financial deal work. Enabling new depths of analysis and automation of the work that shouldn’t be done by hand. Helping bankers and investors do their best work.

+56%

More deal assessments, with the same team.

-50%

Cut memo creation time in half.

-30%

Fewer credit losses or higher return on invested capital.

+61%

More capacity to manage your existing portfolio.

Modules

Modules

Modules

Modules

Designed for all phases of deal work

Designed for all phases

of deal work

Source, analyse, monitor and conduct reporting with greater speed and insight.

benefits

benefits

benefits

benefits

Cover more ground, faster

Cover more ground, faster

Conduct rigorous analysis across all dimensions that impacts your decision. Surface key patterns in vast amounts of data and automate what shouldn't be done by hand.

trained models

trained models

trained models

trained models

The leading model now understands investment situations

The leading model now understands investment situations

The leading model now understands investment situations

The leading model now understands investment situations

AI agents trained by engineers, bankers and investors to understand a business like a tier-1 analyst.

unified

unified

unified

unified

Deep and precise analysis across all your data

Deep and precise analysis across all your data

Upload big, unstructured deal folders, in any format, and our agents will structure it for comprehension and deep analysis.

tailored

tailored

tailored

tailored

Tailored to your firm’s best practice

Tailored to your firm’s best practice

Tailored to your firm’s best practice

Tailored to your firm’s best practice

Our platform is designed to follow your firm’s point of view and policy, rather than a general analysis off-the-shelf.

deep data access

deep data access

deep data access

deep data access

Access raw data from the business

Access raw data from the business

Access raw data from the business

Access raw data from the business

With integrations to the business tech stack, we process raw transaction, product and marketing data.

add capacity

add capacity

add capacity

add capacity

Scale your investment team without hiring

Scale your investment team without hiring

Scale your investment team without hiring

Scale your investment team without hiring

Expand your the deal teams with a network of investment expert agents, coded to strictly follow your investment policy.

Full data access

Full data access

Full data access

Full data access

Uncover signals in the market

Uncover signals

in the market

Capture relevant contextual signals from the market, to map out customer sentiment, category benchmarks, competitive landscape and beyond.

Empowering bankers and investors

Empowering bankers and investors

We partner with frontier banks and investors who want to gain and maintain competitive advantage.

In Germany, Gilion operates as a loan broker. The loans are granted by a third party bank.

In Germany, Gilion operates as a loan broker. The loans are granted by a third party bank.

In Germany, Gilion operates as a loan broker. The loans are granted by a third party bank.

In Germany, Gilion operates as a loan broker. The loans are granted by a third party bank.

In Germany, Gilion operates as a loan broker. The loans are granted by a third party bank.